The housing market is on the cusp of an “inflection point” right now.

That at least, is the takeaway from multiple recent reports as well as conversations Inman had with industry economists. And it’s an inflection point that will impact prices, supply, demand and the lives of agents and consumers alike. It’s a big deal.

But there are two parts to this shift. First, the freewheeling bonanza of the past two years that was fueled, in part, by cheap money is ebbing, and the scales may tip at least slightly more toward buyers.

But second, and significantly, a shift is not a collapse. Though rising mortgage rates are cooling the market, the high rates of the 1980s and 1990s aren’t on their way back, nor is a collapse imminent thanks to the more modest hikes that are taking place. Rates, in other words, are the big driver of this story, but in the end shouldn’t become an Achilles’ heel for real estate going forward.

The shift is happening

The evidence of a shift has been mounting for months, but suddenly feels like it’s everywhere now. Just days ago, for instance, Fannie Mae reported that both homebuilding and home sales are headed for a slowdown.

Jeff Tucker

Jeff Tucker, a senior economist at Zillow, made a similar point, noting that depending on location, the slowdown may already have arrived.

“I think the big story here is the housing market is at or very close to an inflection point where it’s about to start cooling down nationally,” he told Inman. “Given local variation there are parts of the country that have already passed that inflection point.”

Tucker went on to say that Zillow’s analysis indicates the rate of price appreciation nationally should peak and begin to decline “any month now,” with a plateau arriving by next spring — though he stressed that the further out the projection, the less certainty there is.

At the same time, Redfin Chief Economist Daryl Fairweather told Inman that “home price drops are climbing in the national data.”

Daryl Fairweather

“We’re starting to see a bit of relief when it comes to new listings,” she said.

Tucker is also seeing this same rise in inventory, and he described the trend as “a really important piece of the puzzle.”

“That is a good leading indicator that buyers will have more options this summer,” he added.

Before the pandemic, buyers having more options in the summer would have sounded unremarkable. But the severe inventory shortage of the last two years and the resulting double-digit price growth make any upticks in supply and downticks in appreciation significant.

“These are signs that the market is shifting more into buyers’ territory,” Fairweather said, though she added that the market is a long way from the conventional idea of a “buyer’s market.”

The big driver of these shifts is rising mortgage rates. The economists who spoke to Inman noted that rising rates have made housing more expensive and knocked some buyers out of the game, meaning demand is leveling off somewhat.

compared to recent weeks, but not enough of a drop to juice demand back up to where it was months ago. Joel Kan, a forecaster for the Mortgage Bankers Association, described the current rates in a statement as “well above what borrowers were used to over the past two years.”

Whether this is good or bad news depends on where you stand. Tucker noted, for example, that fast-rising prices over the last two years left some people on the sidelines. And many of them might welcome a slower, more buyer-oriented market.

“I think a lot of those folks, a lot of millennials, maybe a lot of people in Gen Z are hoping for a correction, hoping to see prices come back down,” Tucker said.

Rising rates aren’t the apocalypse

Despite the hopes of sidelined would-be homeowners, neither Tucker nor anyone else who spoke to Inman for this story envisions any major price drops in the near future. In other words, while the rate of price appreciation is widely expected to slow, that doesn’t mean it’ll go in reverse.

“We’re still expecting a year from now that prices will be higher than they are now,” Tucker said.

Jessica Lautz

Jessica Lautz, president of demographics and behavioral insights at the National Association of Realtors (NAR), agreed and noted that a bubble is unlikely “because of the hot buyer demand that still exists.”

“There are a lot of buyers who have been waiting for less competition in the market place,” she told Inman.

Like other experts who spoke with Inman, Lautz pointed to rising interest rates as a factor in cooling the once-red hot housing market. But she also said the trend toward rising rates should slow.

“Our current forecast says this is about where rates will go,” she said. “We don’t see them rising substantially more.”

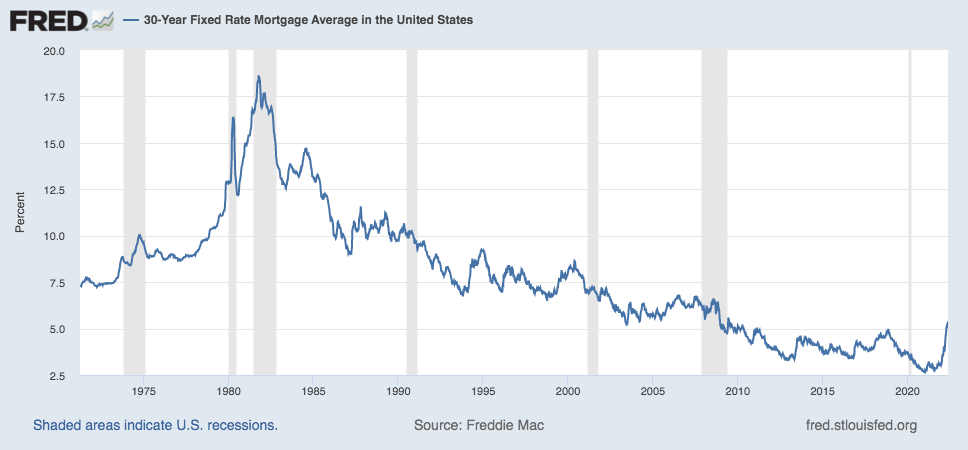

While current mortgage rates may be a shock to homebuyers just entering the market for the first time, they’re also low compared to historical norms. The early 1970s began with average rates in the low 7 percent range, according to the St. Louis Fed, and they steadily rose to more than 18 percent in the early 1980s. Rates didn’t fall to below 6 percent until the early 2002s.

Credit:St. Louis Fed

Looking at the St. Louis Fed’s graph, the current spike in rates is notable, but no where near what was happening in the 1980s.

Inman asked the experts who spoke out for this story if they envisioned rates returning to the highs of the 1980s and 1990s. They didn’t.

Fairweather instead said that the trend toward low rates is tied to a variety of economic conditions, for example the U.S. becoming a more desirable place for foreign investment. No one has a crystal ball, but Fairweather said the conditions that led to low rates still exist and she expects spikes to be temporary.

“Once these inflation woes are resolved,” she explained, “rates will start going in their long term trajectory, which is down.”

Fairweather also doesn’t see a bubble on the horizon, saying that the current shift is likely to be a more minor moment of cyclicality akin to 2018 rather than a monumental change like what happened in 2008.

“We don’t expect that there’s a national home price bubble,” she said.

The dangers going forward

Still, there are some things that trouble the pros. Inman asked the experts if there was ever likely to be a time that was as good for buying a house as the last two years. Though the last two years saw rapidly rising prices, low mortgage rates also made borrowing incredibly cheap. If prices keep rising and mortgage rates are up, does that mean the people who didn’t get into the market missed a once-in-a-life-time opportunity?

It’s not exactly so simple.

Fairweather, for instance, strongly advised against trying to time the market, saying the best time to buy a house is when a person needs a house.

In Tucker’s case, he described the last two years as a “strikingly good bargain, mainly on the basis on interest rates,” and noted that a major concern of his is that “so many first time homebuyers are priced out of the market.”

Aside from complicating the typical path to homeownership and wealth building for many Americans, this situation could also ripple out and cause problems for the supply of new homes — which in the end may mean homes will remain expensive.

“My fear is that a lot of builders will pull back and stop building as fast as they have been,” Tucker said. “We need builders to continue firing on all cylinders. If they’re not building and investing, that will guarantee that homes remain unaffordable for large swaths of people.”

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link