If you’ve been keeping an eye on mortgage rates lately, you might feel like you’re on a roller coaster ride. One day rates are up; the next they dip down a bit. So, what’s driving this constant change? Let’s dive into just a few of the major reasons why we’re seeing so much volatility, and what it means for you.

The Market’s Reaction to the Election

A significant factor causing fluctuations in mortgage rates is the general reaction to the political landscape. Election seasons often bring uncertainty to financial markets, and this one is no different. Markets tend to respond not only to who won, but also to the economic policies they are expected to implement. And when it comes to what’s been happening with mortgage rates over the past couple of weeks, as the National Association of Home Builders (NAHB) says:

“. . . the primary reason interest rates have been on the rise pertains to the uncertainty surrounding the presidential election. Although the election is now complete, there continue to be growing concerns over budget deficits.”

In the short term, this anticipation has caused a slight uptick in mortgage rates as the markets adjust and react. Additionally, factors like international tensions, supply chain disruptions, and trade policies can drive investor sentiment, causing them to seek safer assets like bonds, which can indirectly impact mortgage rates. Essentially, the more global or domestic uncertainty, the greater the chance that mortgage rates may shift.

The Economy and the Federal Reserve

Inflation and unemployment are two other big drivers of mortgage rates. The Federal Reserve (the Fed) has been working to bring inflation under control, and has been closely monitoring the economy as they do. And as long as inflation continues to moderate and the job market shows signs of maximum employment, the Fed will continue its plans to cut the Federal Funds Rate.

Although the Fed doesn’t set mortgage rates, their decisions do have an impact, and typically a cut leads to a mortgage rates response. And in their November 6-7th meeting, the Fed had the data they needed to make another cut to the Federal Funds Rate. And while that decision was expected and much of the mortgage rate movement happened prior to that meeting, there was a slight dip in rates.

What To Expect in the Coming Months

As we look ahead, mortgage rates will respond to changes in the Fed’s policies and other economic indicators. The markets will likely remain in a wait-and-see mode, reacting to each new development. And, with the transition of a new administration comes an element of unpredictability. A recent article from The Mortgage Reports explains:

“Today’s economic indicators come with mixed pressures on mortgage rates and we’re likely to be in for a good amount of volatility as markets adjust and respond to the election . . .”

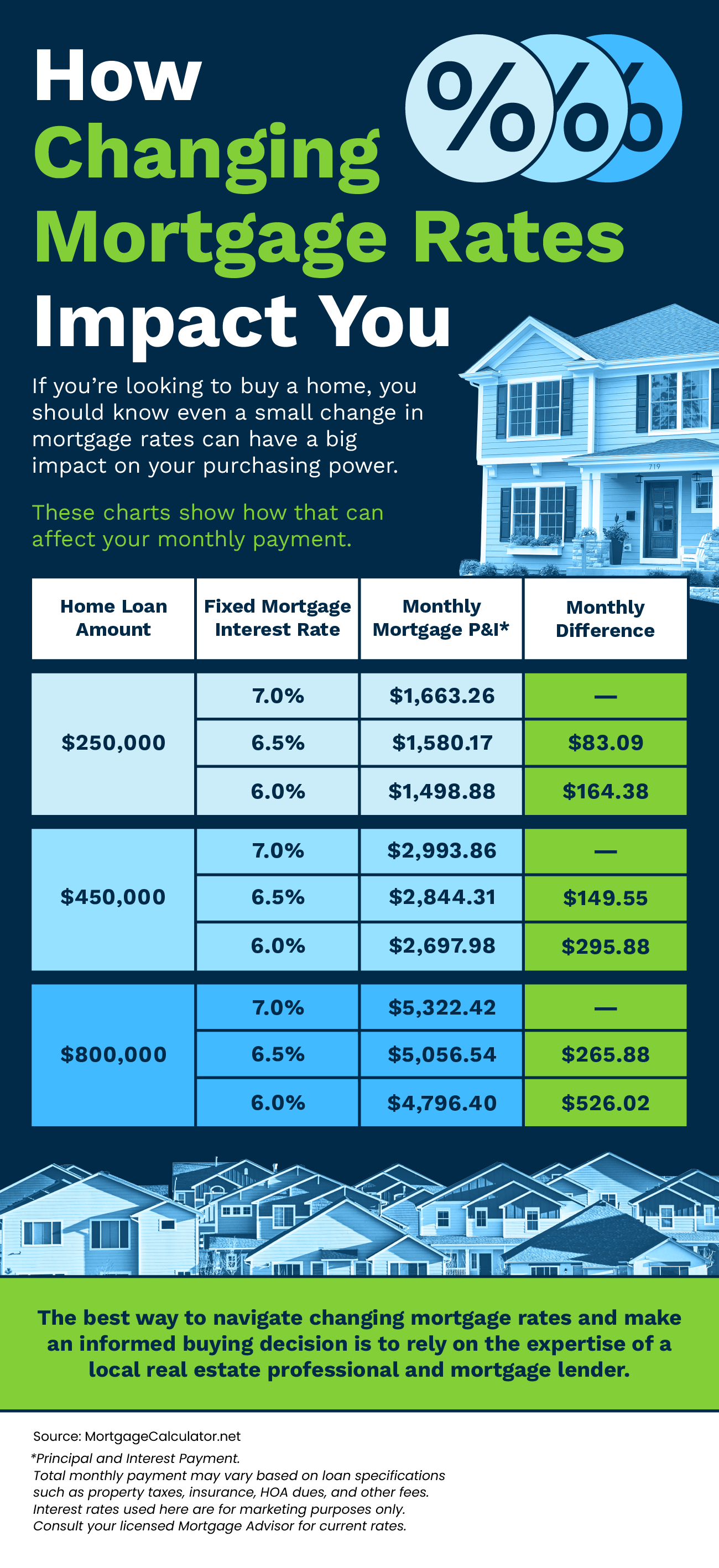

The best way to navigate this landscape is to have a team of real estate experts by your side. Professionals will help you understand what’s happening and can provide you with the guidance you need to make informed housing market decisions along the way.

Bottom Line

The takeaway? Today’s mortgage rate volatility is going to continue to be driven by economic factors and political changes.

Now is the time to lean on experienced professionals. A trusted real estate agent and mortgage lender can help you navigate through it. And with the right guidance, you can make informed decisions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link