Expert Quotes on the 2024 Housing Market Forecast

If you’re thinking about buying or selling a home soon, you probably want to know what you can expect from the housing market in 2024. In 2023, higher mortgage rates, confusion over home price headlines, and a lack of homes for sale created some challenges for buyers and sellers looking to make a move. But what’s on the horizon for the new year?

The good news is, many experts are optimistic we’ve turned a corner and are headed in a positive direction.

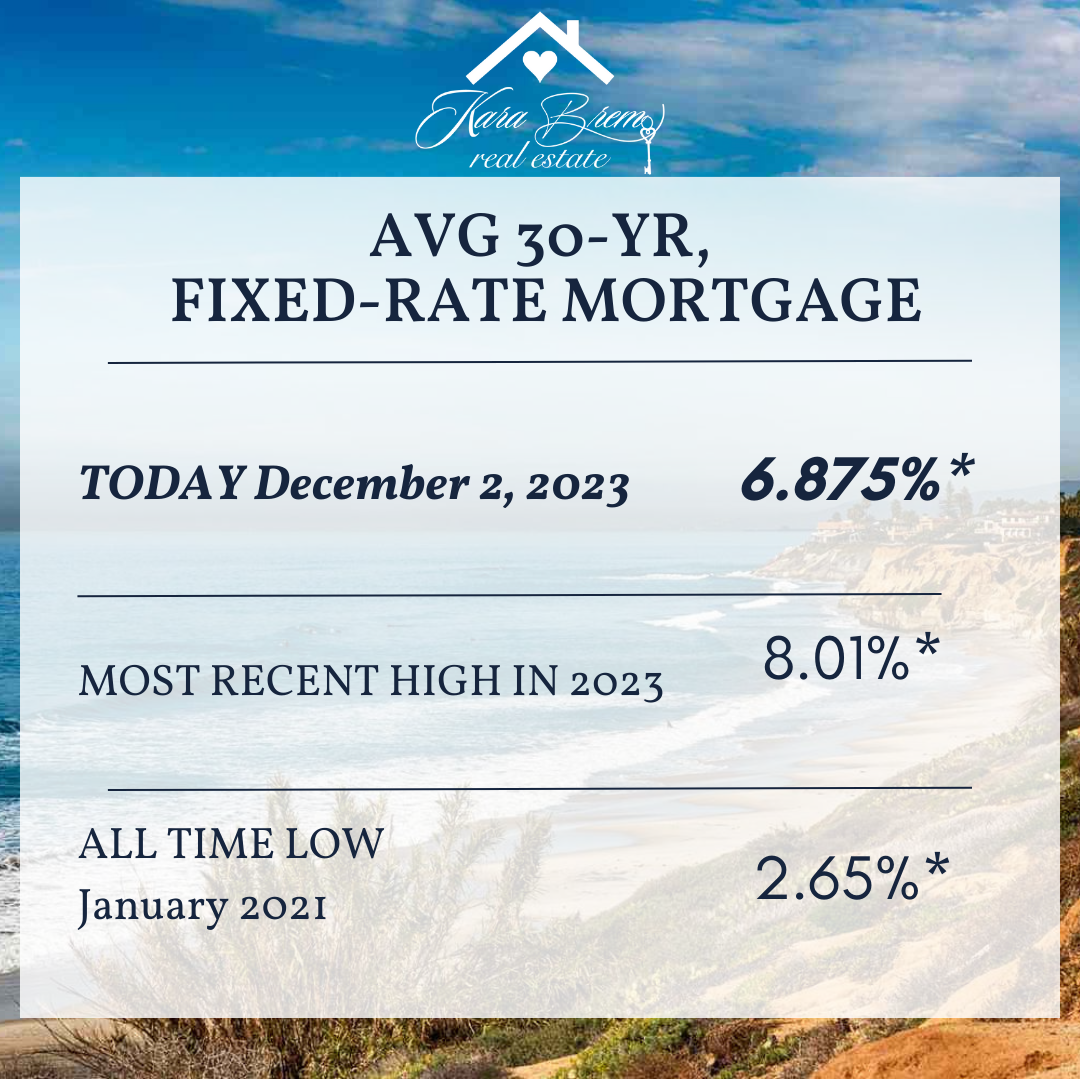

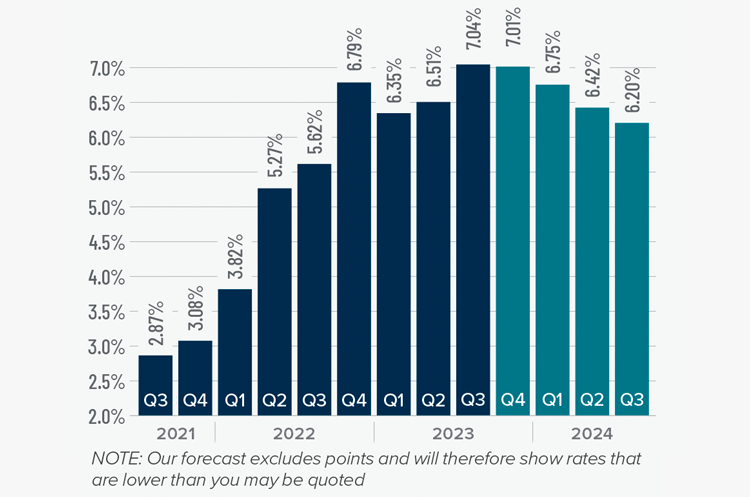

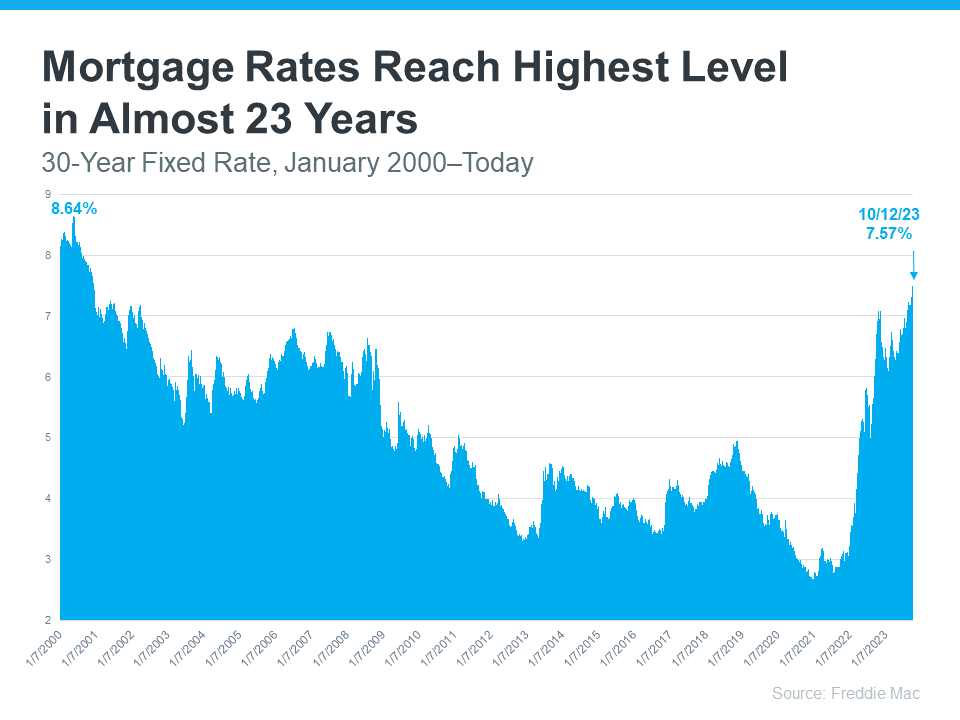

Mortgage Rates Expected To Ease

Recently, mortgage rates have started to come back down. This has offered hope to buyers dealing with affordability challenges. Mark Fleming, Chief Economist at First American, explains how they may continue to drop:

“Mortgage rates have already retreated from recent peaks near 8 percent and may fall further . . .”

Jessica Lautz, Deputy Chief Economist at the National Association of Realtors (NAR), says:

“For home buyers who are taking on a mortgage to purchase a home and have been wary of the autumn rise in mortgage rates, the market is turning more favorable, and there should be optimism entering 2024 for a better market.”

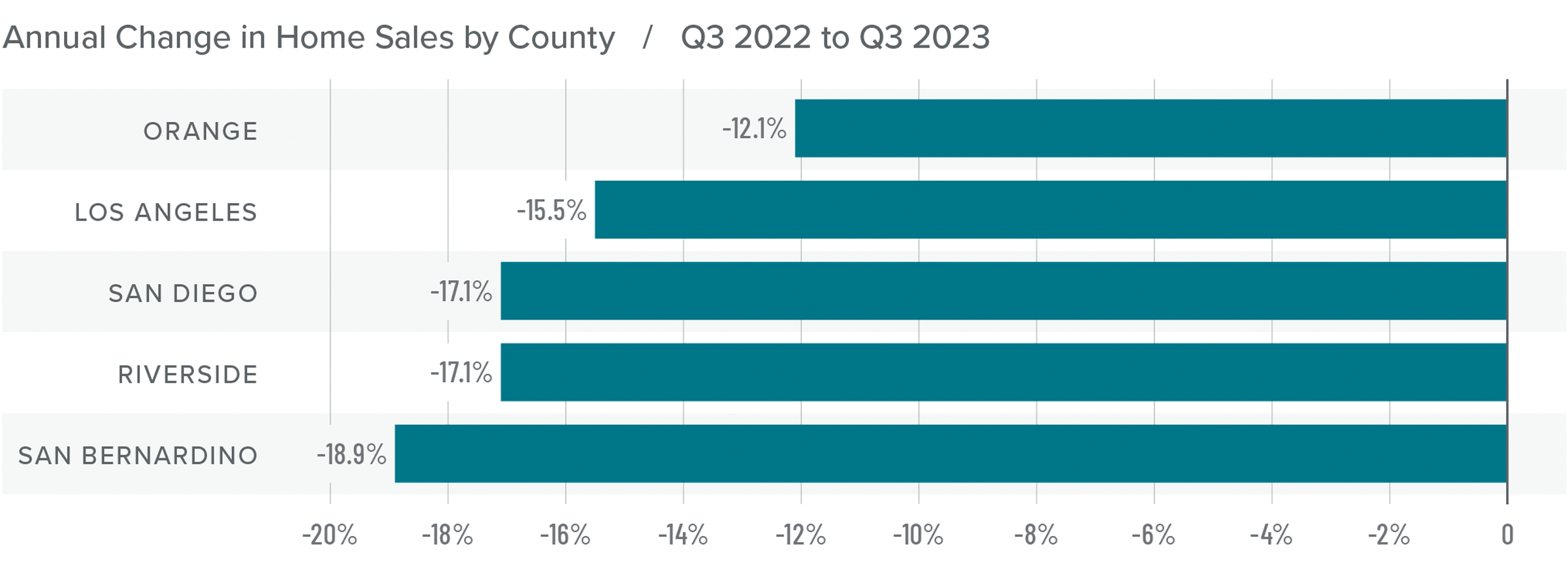

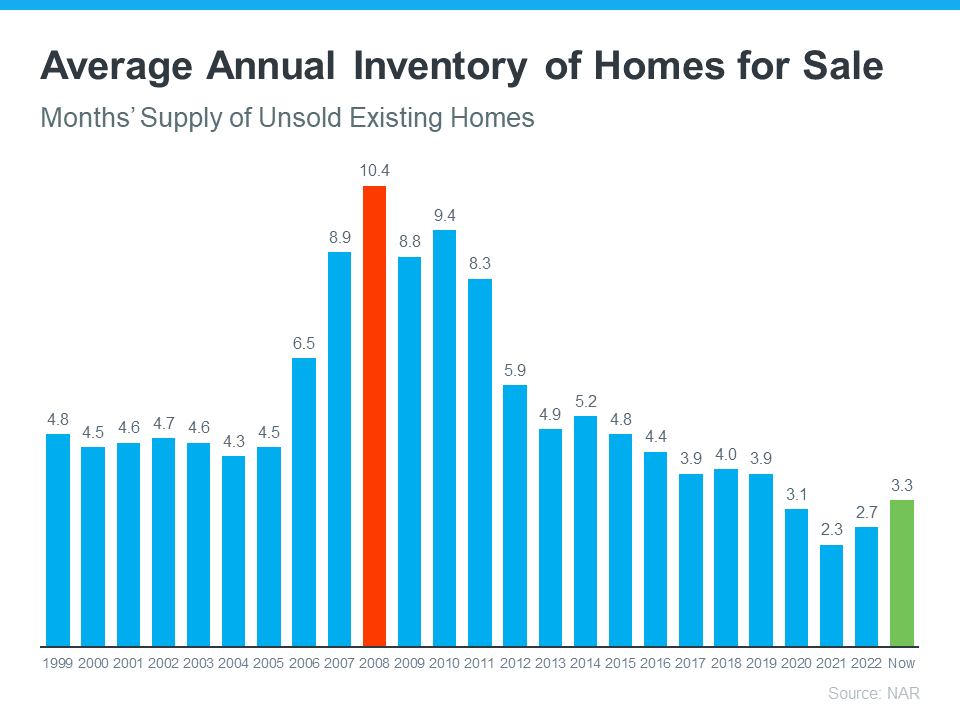

The Supply of Homes for Sale May Grow

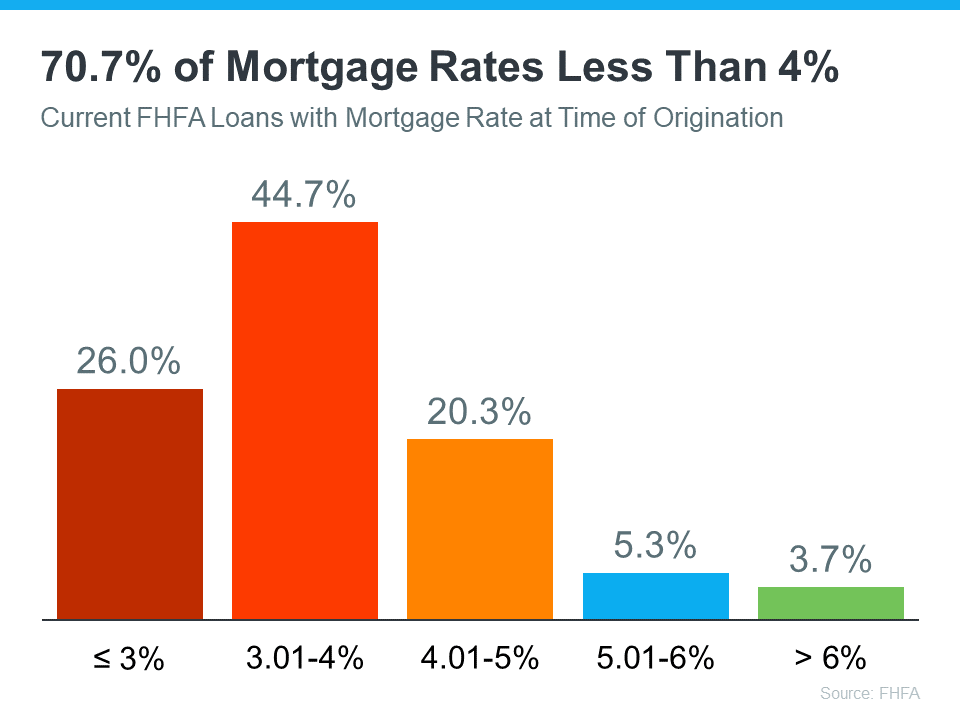

As rates ease, activity in the housing market should pick up because more buyers and sellers who had been holding off will jump back into action. If more sellers list, the supply of homes for sale will grow – a trend we’ve already started to see this year. Lisa Sturtevant, Chief Economist at Bright MLS, says:

“Supply will loosen up in 2024. Even homeowners who have been characterized as being ‘locked in’ to low rates will increasingly find that changing family and financial circumstances will lead to more moves and more new listings over the course of the year, particularly as rates move closer to 6.5%.”

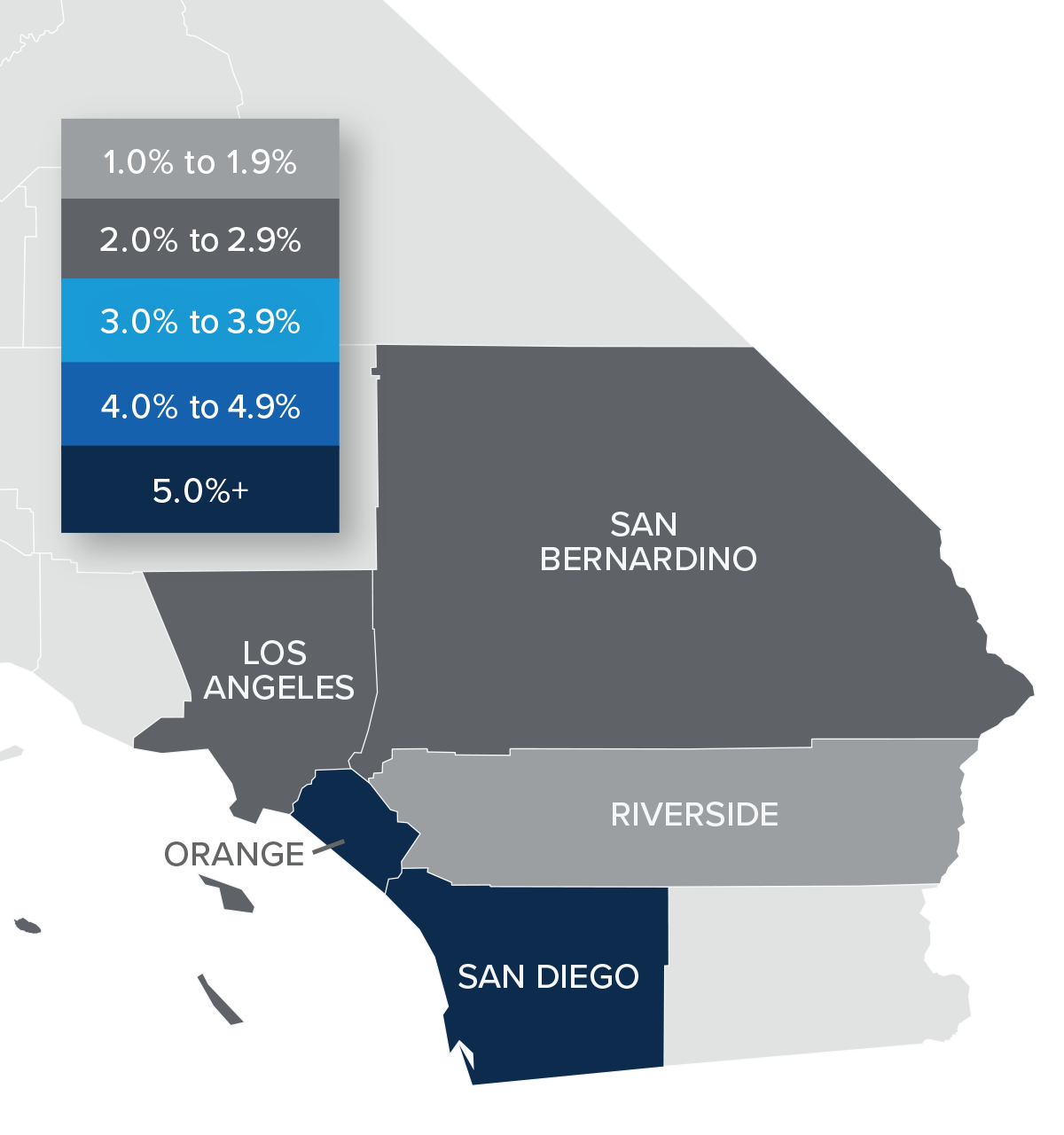

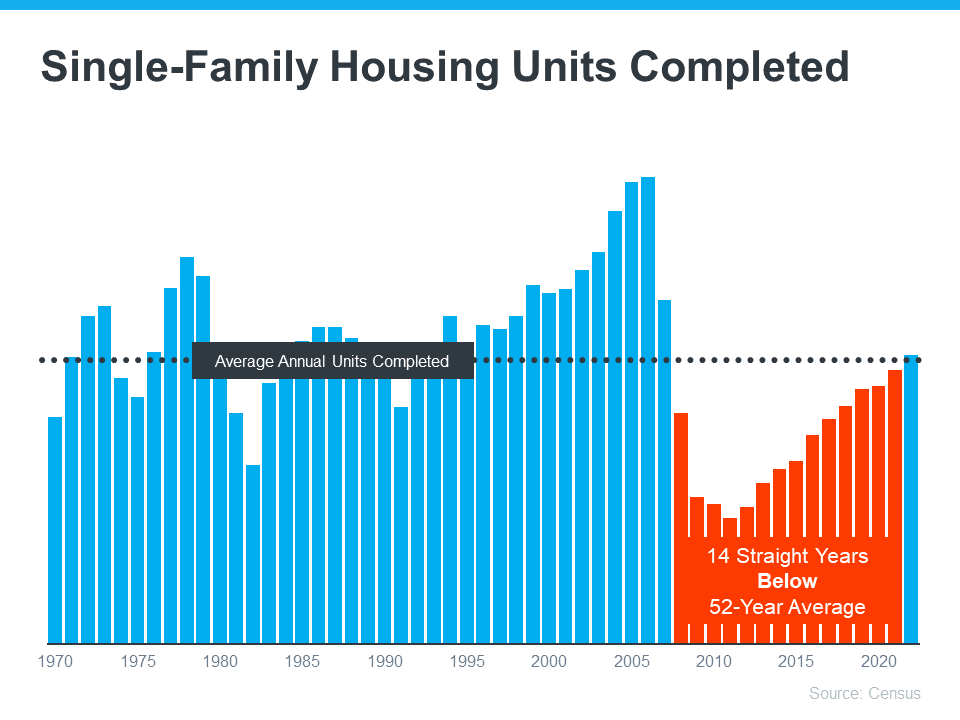

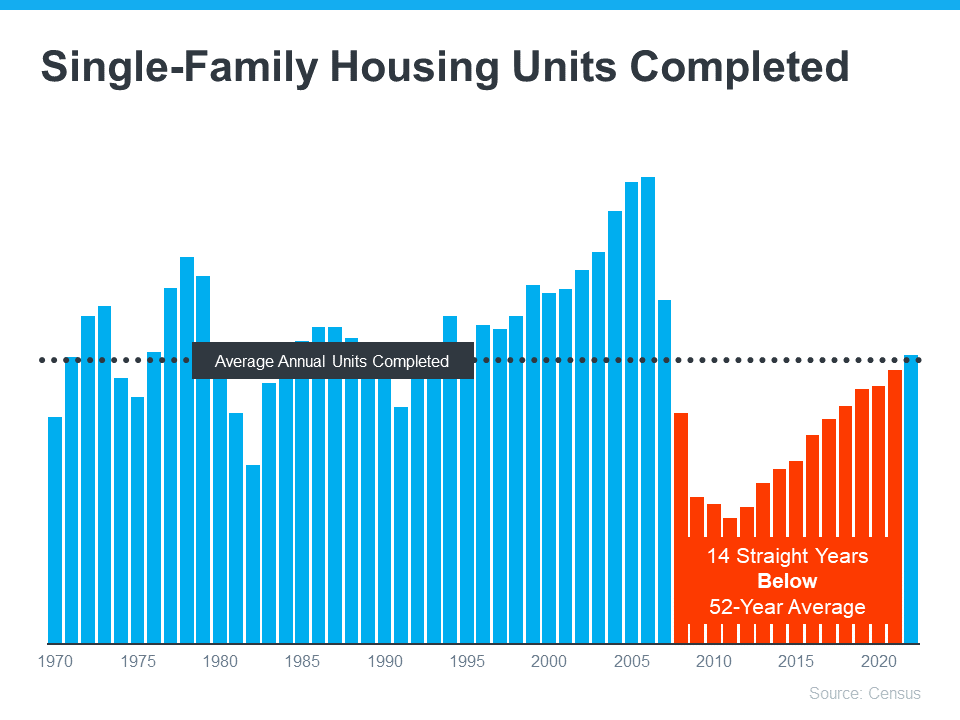

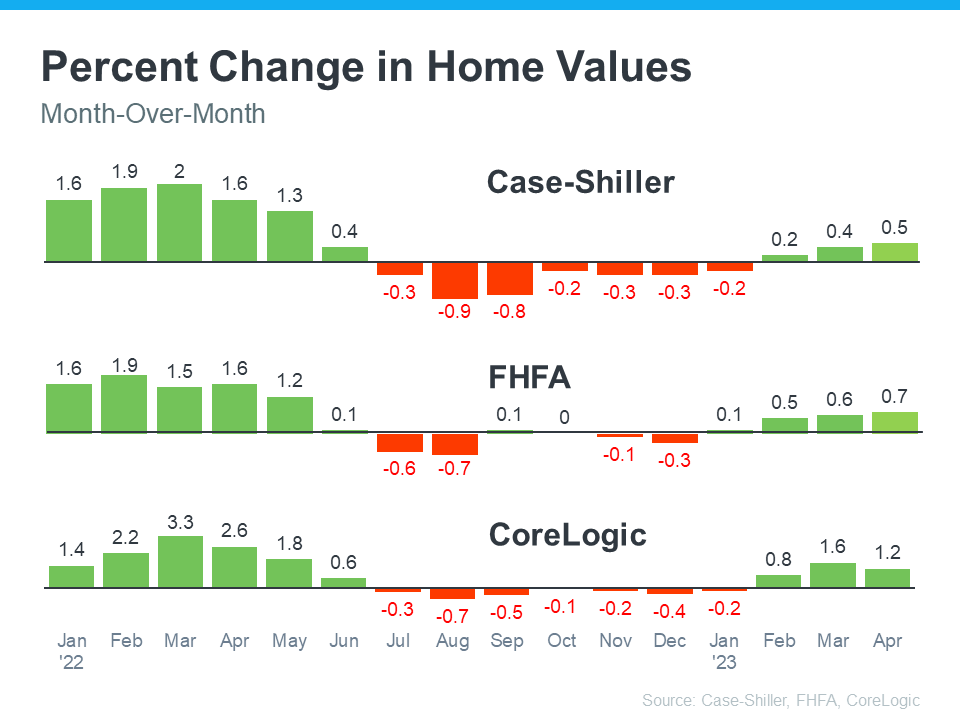

Home Price Growth Should Moderate

And mortgage rates pulling back isn’t the only positive sign for affordability. Home price growth is expected to moderate too, as inventory improves but is still low overall. As the Home Price Expectation Survey (HPES) from Fannie Mae, a survey of over 100 economists, investment strategists, and housing market analysts, says:

“On average, the panel anticipates home price growth to clock in at 5.9% in 2023, to be followed by slower growth in 2024 and 2025 of 2.4 percent and 2.7 percent, respectively.”

To wrap it up, experts project 2024 will be a better year for the housing market. So, if you’re thinking about making a move next year, know that early signs show we’re turning a corner. As Mike Simonsen, President and Founder of Altos Research, puts it:

“We’re going into 2024 with slight home-price gains, somewhat easing inventory constraints, slightly increasing transaction volume . . . All in all, things are looking up for the U.S. housing market in 2024.”

Bottom Line

Experts are optimistic about what 2024 holds for the housing market. If you’re looking to buy or sell a home in the new year, the best way to ensure you’re up to date on the latest forecasts is to partner with a trusted real estate agent. Let’s connect.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link